Numerous analyses have documented that a majority of company acquisitions end up as financial failures because the price that was paid exceeds the value.

The reasons behind the tendency to overpay surely varies. However, without relevant information on the table, factors such as the human overoptimism about the likelihood of success, the economic worldview promoting and demanding growth along with the managerial strive for results, are likely to play a decisive role in the pricing process and increase the risk of overpaying.

The information needed to make informed pricing decisions is, however, easily provided: By working out an integrated sensitivity analysis of the valuation of the target company, the relationship between a price and the expected value of the company can be established and used actively in the pricing process.

The valuation of a company is based on an assessment of the future financial results of the company in question. The assessment is based on an estimation of the parameters that are decisive for the company’s future value creation including growth in revenues and earnings and the ability to utilize the capital invested.

The estimation of the parameters is an assessment of the future to find the most likely outcome of future states and will as such always involve elements uncertainty. As a result, the valuation in itself is uncertain and the value resulting from the valuation will represent the most likely value.

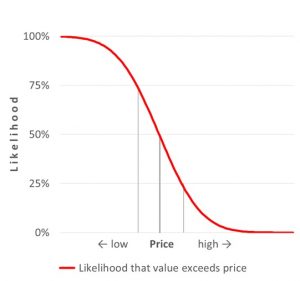

To make active use of the valuation, the total sample space of all possible values resulting from the use of all combinations of likely values of the key parameters needs to be established and described. With this information at hand, it becomes possible to evaluate the price on a relevant scale: The likelihood that the value is higher or lower than a given price, subject to the uncertainty of the combined set of parameters upon which the valuation is based.

The relation between price and value

This relationship between price and expected value may be described as a “Z-curve”. Follow the link to find out how it is derived and to see an example of it’s use –